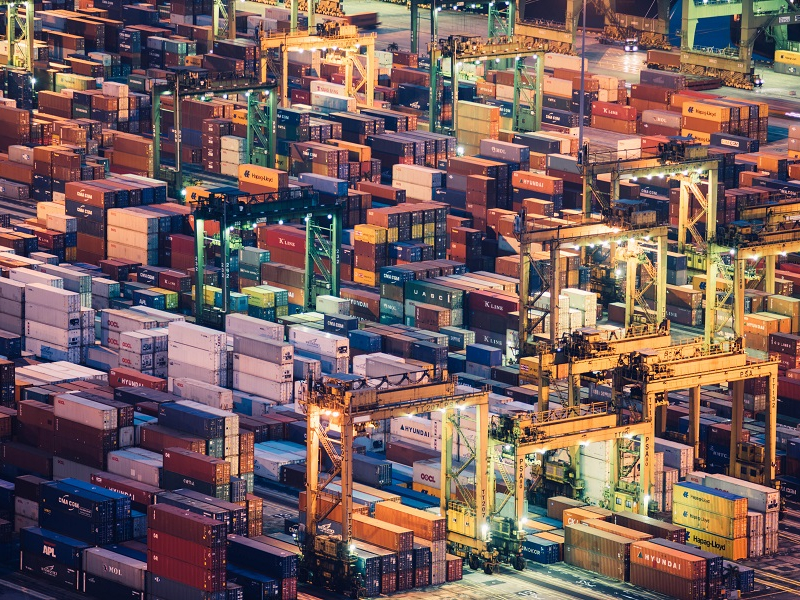

Many businesses involve the importing and exporting of goods. Here is a general guide for anyone out there who would like to get into the trading business.

Step 1: Register for a company and activate a Customs Account

You will need an entity to engage in import and export activities in Singapore. You can register for a company with the Accounting and Corporate Regulatory Authority (ACRA). You can engage an ACRA Registered Filing Agent to assist in the registration of your company. Once you have your entity set up, you will receive a Unique Entity Number (UEN), the company officers may register your company CorpPass, add and assign the required e-services. With this, you can activate your Customs Account.

Step 2: You will need to check whether your goods are controlled

Certain goods are subject to restrictions in Singapore. You can search whether the goods that you want to import are controlled on the Singapore Customs website. The link to the Harmonised System/ Competent Authority (HS/ CA) Product Code Search and Customs Ruling Database can be found here. If your item is subject to certain controls, the name of the CA will be indicated next to its HS code. You will have to check with the relevant CA on the licensing requirements.

Step 3: Apply for Inter-Bank GIRO

You and your declaring agent must have an Inter-Bank GIRO (IBG) arrangement with the Singapore Customs to make payment of duties, taxes, fees, penalties and other charges on services offered by Singapore Customs. You can fill up the Application for Inter-Bank GIRO form and mail it out to the Singapore Customs’ address as indicated in the form.

Step 4: Furnish Security

You are required to furnish security for transactions involving

- Dutiable Goods

- Temporary import of goods for approved purposes

- The operation of licensed premises such as licensed warehouses and excise factories

The security should be in the form of a Banker’s Guarantee, Finance Company Guarantee or an Issuance Bond.

Step 5: Apply for a Customs Import Permit

You can appoint a Declaring Agent to apply for a Customs Permit on your behalf or you can apply for it yourself. To do it yourself, you will need to register as a Declaring Agent and apply for a TradeNet User ID.

All Customs Permit applications must be submitted via TradeNet which can be accessed through TradeNet front-end software from an approved software vendor or Government Front-End module.

For the import of all goods

All goods will require a permit that can be obtained online via TradeNet. There are some exceptions to this rule. Permits are not required for trade samples of uncontrolled items provided that the total value of the items do not exceed SGD$400 in costs, insurance and freight (CIR).

For the import of controlled goods

An example of such goods would be cigarettes, petrochemicals, animal and food products. Controlled goods require additional permits from the relevant CA. If you are using a freight forwarder or cargo agent, they may assist with this additional permit.

Please note that all documentation has to be kept for a period of five years.

Singapore Customs does provide a Quick Guide for Importers on their website. The Quick Guide for Importers can be found here.

When in doubt, seek legal advice or consult an experienced ACRA Filing Agent.

Yours Sincerely,

The editorial team at Acra Filing Agent

For more useful articles and videos, visit the ACRA Filing Agent Useful Articles Page.

If you would like to submit a question or would like us to do an article on certain topics, please email us at [email protected]